PayTrace is an exclusive payment gateway system that has been created with a developer-focused design and stresses on providing great customer support. It offers advanced merchant services. The amazing thing about PayTrace Payment Gateway Magento2 is the fact that it provides services like mail, phone, point-of-sale, and online transactions on top of mobile services and even supports cash advance service. It is a sturdy system which can easily be customized. You can easily integrate it into virtually any merchant credit card service. The amazing fact is, it comes with an all-in-one payment support solution.Here, you have it a basic overview of PayTrace payment gateway Magento2. In the forthcoming sections of this write-up, we have provided different facets pertaining to this amazing

online payment gateway. We promise after reading this content piece, you will have a fair piece of information pertaining to this Magento extension which will be highly useful when it comes to taking the wise decision when it comes to purchasing it.

Buy PayTrace Payment Gateway For Magento 2 😊

Let’s start with the features and services pertaining to this ingenious payment gateway.

Swift point-of-sale transactions

PayTrace provides encrypted card readers and receipt printers which are amalgamated into a comprehensive PCI compliant point-of-sale system. The beautiful part is, it is possible to conduct transactions with or without the card. The ultimate objective of this exercise is to ensure that the customers’ transactions are processed swiftly.

The facility of mail and phone transactions

It is possible to call and email credit card transactions. This includes recurring billing for products and services. The amazing part is, there is a secure customer storage vault combined with fraud tools that have been developed to protect your data from theft.

Assists in eCommerce transactions

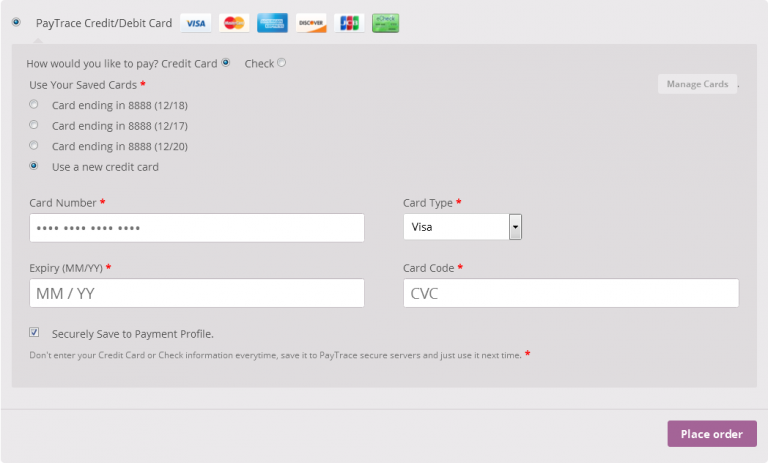

PayTrace provides service offerings that can enhance system security when it comes to conducting eCommerce transactions. This includes shopping carts, hosted solutions, and an emphasis on development.

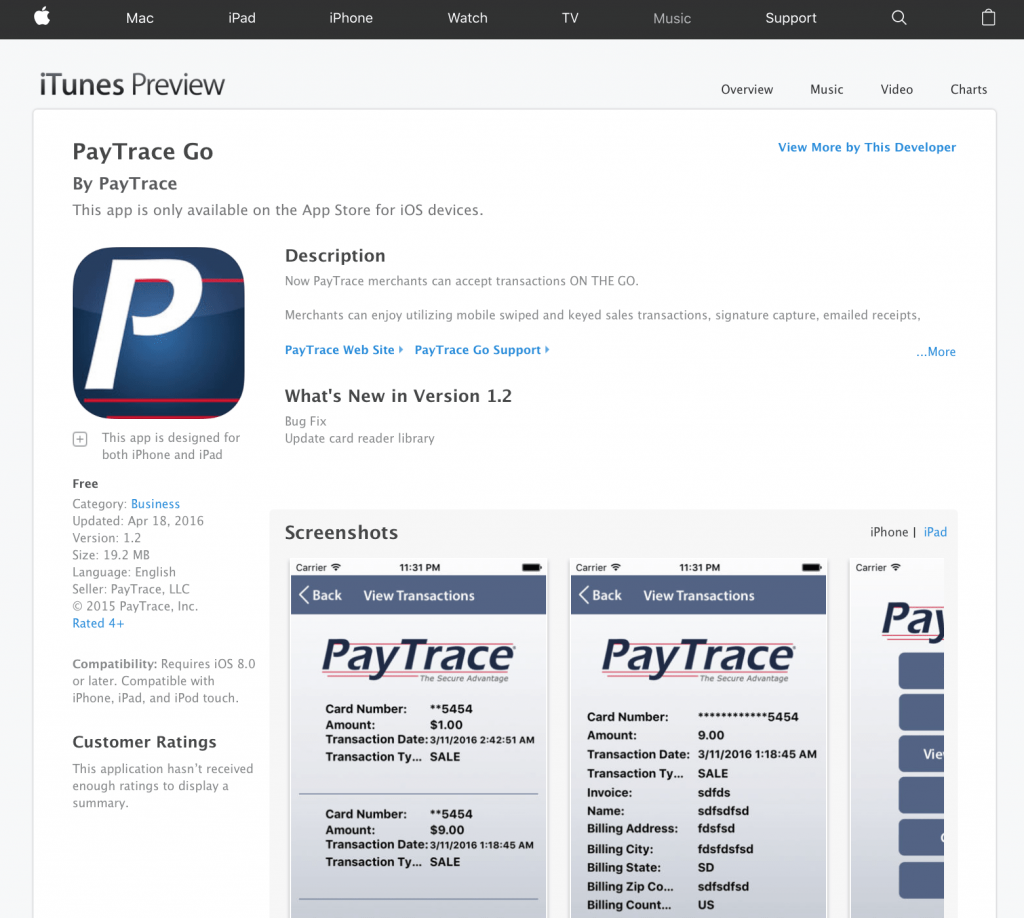

Encourages mobile transactions

With the help of mobile application it is possible for you to withdraw payments anywhere using the iOS device. There is an extra card reader which enables you to perform swiped transactions. Other transactions can easily be manually keyed into the app.

The Pricing Factor

PayTrace provides two pricing plans: “Basic” and “Pro” depending on your requirements as a merchant.Let’s now look at the two plans in details.

Basic Plan

PayTrace Basic is free to set up. But, for each vertical terminal, you need to spend a $15 monthly fee. There is also an additional $0.30 transaction processing fee.

Pro Plan

PayTrace Pro comes with a $75 account setup fee. There is also a $20 monthly fee for each and every virtual terminal. You also need to incur a $0.10 transaction processing fee.

Remember, PayTrace Basic is a sturdy solution which encompasses mobile-based and internet-based payment processing and the ability to connect with card readers and receipt printers. The amazing part is, both PayTrace Basic and PayTrace Pro are highly secure and compliant with PCI standards. On top of this, both of them come with round-the-clock support 24×7. PayTrace Basic can conduct transactions for all major credit cards. How? Through credit card readers or through a manually entered transaction.

Let’s now divert our attention to other salient features of PayTrace.

- 1. Facility to store credit card transactions which will assist in running them at a scheduled time.

- 2. Very easy to refund, partial refund, and void credit card transactions.

- 3. Very swift to alter the credit card transactions before they have been settled.

- 4. Easy settlement of credit card transactions instantly by the end of the day.

- 5. Processing of transactions through iPhone or other smartphones.

- 6. Generating receipts and a maximum of three custom reports.

PayTrace Pro integrates all the features of PayTrace Basic on top of other features that have the ability to enhance the customer service procedure.Let’s now look at some of these additional features provided by PayTrace Pro.It is possible to maintain the “n” number of user sign-ins. You can even link multiple PayTrace accounts. The ultimate objective of providing multiple account option to merchants is to give them the ability to control their cash flow. It also eases their task of assigning duties to their employees.Merchants can easily store customer information for later use. This information is kept in use with the help of tokenization and encryption.Merchants have the ability to create and charge multiple accounts at a single go. This way they can now create and charge batches of transactions at a single instance. This feature is especially helpful when it comes to recurring payments. But, there is an additional $5 fee that is charged every month for availing this feature. This fees can increase a bit with the addition of NSF charges.It is easy to maintain customer profiles that can be used for better customer service. These customer profiles can be employed in third-party solutions, including a customer relationship management suite or a Salesforce.It is possible to create 15 custom reports for analysis. There are three types of custom reports that you can prepare using the basic versions of the software. This custom report assists in getting comprehensive scrutinization of revenue or fees trend.Merchants can develop an optional pre-integrated product shopping cart. For those who do not want to start from scratch, a pre-integrated product shopping cart is available to be plugged into a prevailing site. But, there is an additional charge of $ 15 on a monthly basis to avail this service.For developers, there is an advanced API system which assists them to integrate their online payment gateway system with their eCommerce infrastructures.It has got to be said that merchants who are looking to customize their online payment gateway service for their website and their specific requirements will find PayTrace Pro solution highly beneficial.Alternatively, if the merchants do not want any advanced features they may find PayTrace Basic more appropriate for their requirements.

The Hardware Requirements for Using PayTrace

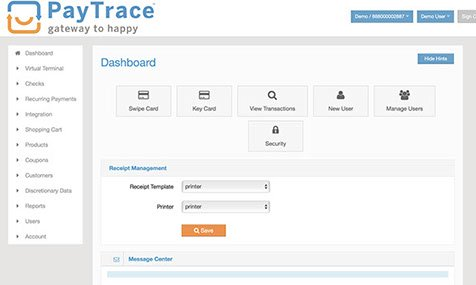

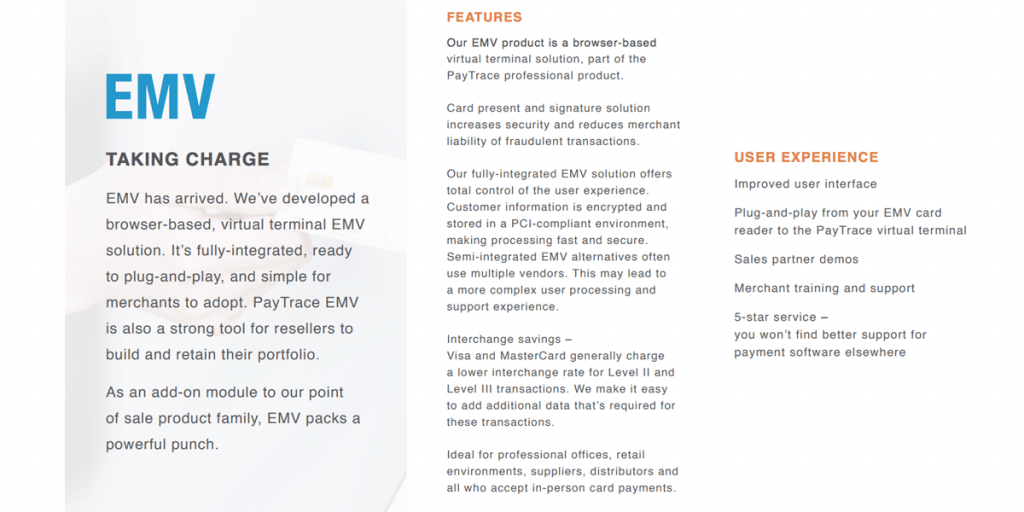

PayTrace provides a comprehensive EMV product called as PayTrace EMV. It is a new mechanism to showcase the way credit card payments are processed. How does it operate? With the help of a virtual terminal, a browser-based interface can be employed to process both keyed-in and swiped transactions.

The virtual terminal of PayTrace can be employed with any standard card reader and receipt printer. The system has been designed in such a way that it can work with any device having access to a standard web browser. If you are using it for conducting mobile payments, it works primarily with iOS. But it also supports BlackBerry devices. PayTrace is compatible with a version of iOS of at least 4.3. But, it can even be used in a standard web-browser in other operating systems that support browsing technologies. The only loophole is, in such devices, you will not get access to native mobile features.

Security

It is extremely vital for PayTrace’s security to be extremely tight. Reason? This ingenious payment gateway will be controlling and transmitting payment data of all personnel working in an organization. To ensure that there is the utmost privacy and security it meets advanced security standards like Level I PCI compliance. It employs tokenized security technology. What is this technology? With the help of tokenization, it becomes possible to protect the customers from potential fraud. These systems have been developed with the objective to verify payments without the need to transmit card information and bank account information. This way the payment data becomes less vulnerable. The other amazing thing about tokenization system is that it does not store payment information. Instead, it stores tokens. This way the customers can swiftly complete the transaction without worrying about leaving their payment data accessible to others. Without tokenization, systems are required to store and transmit encrypted account information. The interesting part is, although the data may be encrypted, it is still being stored. With the help of SSL technology, the identifiable information is protected while it is being transmitted. By employing multi-factor authentication processes it is possible to protect users from their accounts being compromised. It is possible for merchants to set different permissions for users. With timely time-out connections, it is possible to greatly reduce the risk of unauthorised account access.

The Finale

In this write-up, we have provided comprehensive information pertaining to PayTrace Payment Gateway Magento 2. In comparison to other

payment gateway providers, PayTrace is one of the best you will ever get basically because it is a Magento2 extensions. Furthermore, it has all the qualities of being the most helpful resource ever for the merchants when it comes to completing transactions. With so many ingenious features and two best pricing plans, as a merchant rest assured to get the best results for your business by availing this interesting Magento extension.

About Author

Dipak Patil - Delivery Head & Partner Manager

Dipak is known for his ability to seamlessly manage and deliver top-notch projects. With a strong emphasis on quality and customer satisfaction, he has built a reputation for fostering strong client relationships. His leadership and dedication have been instrumental in guiding teams towards success, ensuring timely and effective delivery of services.